The cost principle requires that when assets are acquired, they be recorded at: A appraisal value B. historical cost C. market price D. exchange price paid

You come across a beautiful piece of furniture crafted in a bygone era, with intricate details and impeccable craftsmanship. The seller explains that the piece is valued for its beauty, historical significance, and rarity. One of the prime objectives of accrual accounting is for the public markets to remain stable – but within reason, of course (i.e. reasonable volatility).

- The historical cost principle is important because it allows businesses to track the value of their assets over time, even if that value changes.

- However, many financial experts argue that historical cost may be too conservative a value for assets because the sum is not adjusted even in stable market conditions.

- If the value of the stock increases to $1,200, the investment is still recorded at its original cost of $1,050.

- As an added reality check, while appreciation is ignored in historical cost, amortization and depreciation of an asset is not.

The subtraction of accumulated depreciation from the historical cost results in a lower net asset value, ensuring no overstatement of an asset’s true value. Without necessary adjustments, the historical price of an asset is still reliable, although not entirely useful in the long term. Knowing that a company might have bought an office building for $5,000, years The Historical Cost Principle Requires That When Assets Are Acquired ago, does not provide an overview of the current fair value of an asset. The amount of depreciation that can be claimed as a deduction on a tax return often differs from the depreciation expense recorded on financial statements. As a result, adjustments must be made to the financial statements to reflect the correct amount of depreciation for tax purposes.

Valuation of Property, Plant, and Equipment – Example of Historical Cost Principle

With asset impairment, an asset’s fair market value has dropped below what is originally listed on the balance sheet. An asset impairment charge is a typical restructuring cost as companies reevaluate the value of certain assets and make business changes. Financial assets are presented at actual historical cost, which has not been modified for price changes. Consequently, the reported amounts for some financial reports often differ from their actual market price. The value of an asset is likely to deviate from its original purchase price over time. The acquisition was made 15 years ago; however, in the current market, the building is worth over $12,000,000.

- Fair value accounting requires companies to estimate the current market value of the financial instrument, which can change over time.

- This allows for a more accurate representation of what the company would receive if the assets were sold immediately, and it is useful for highly liquid assets.

- Fixed assets, such as buildings and machinery, will have depreciation recorded on a regular basis over the asset’s useful life.

- This valuation method can be used when the inventory consists of unique or high-value items, such as art or jewelry.

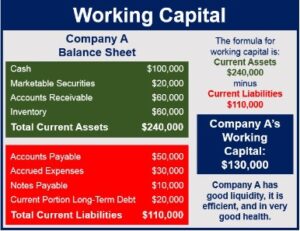

- Highly liquid assets are exceptions to the cost principle and should be recorded at their current market value.

- For example, a company may manipulate its financial statements by using a higher inflation index to overstate the value of its assets.

However, if the product cost decreases to $8 each, the inventory may be written down to a lower cost of $8,000. The cost principle means that a long-term asset purchased for the cash amount of $50,000 will be recorded at $50,000. If the same asset was purchased for a down payment of $20,000 and a formal promise to pay $30,000 within a reasonable period of time and with a reasonable interest rate, the asset will also be recorded at $50,000. The Historical Cost Principle requires the carrying value of assets on the balance sheet to be equal to the value on the date of acquisition – i.e. the original price paid.

Advantages of the Historical Cost Principle in Accounting

Specific identification involves identifying and valuing each item of inventory separately. This valuation method can be used when the inventory consists of unique or high-value items, such as art or jewelry. For example, suppose a company holds inventory that has significantly increased in value since it was purchased. In that case, the value of the stock on the balance sheet will not reflect its current market value.

The historical cost will appear on the balance sheet and would not change based on market expectations of its value. Investors and analysts rely on financial statements to assess a company’s financial health and make informed investment decisions. Financial statements prepared using the Historical Cost Principle provide a clear and consistent basis for analysis. The important distinction is the high liquidity of these short-term assets, as their market values reflect a more accurate representation of these assets’ values. Historical cost is what your company paid for an asset when you originally bought it. That cost is verifiable by a receipt or other official record of the initial transaction.

What are the benefits of the cost principle?

Using the historical cost principle makes analyzing and comparing financial statements across different periods and companies easier, which can help businesses make better-informed financial decisions. This article will delve into the concept and importance of the historical cost principle in businesses. We will explore the advantages and disadvantages of using this principle, its exceptions, and the alternatives available.

- The subtraction of accumulated depreciation from the historical cost results in a lower net asset value, ensuring no overstatement of an asset’s true value.

- However, it is important to know that the historical cost may not necessarily be a true reflection of the fair value of an asset.

- Using historical cost, businesses can determine the cost of assets, liabilities, and equity at the time of acquisition, enabling managers to make informed decisions based on the business’s financial position.

- There are some exceptions to the historical cost principle which need to be mentioned.

- Using the Historical Cost Principle, the tax base often equals the book value of assets and liabilities reported on the financial statements.

- It is a static snapshot of asset value at the time of purchase and provides no measure of how value may have changed over time.

It is a static snapshot of asset value at the time of purchase and provides no measure of how value may have changed over time. According to the historical cost principle, assets should be documented at the cost for https://kelleysbookkeeping.com/how-do-capital-accounts-in-llcs-work/ which they were first… In general, the more time that has passed since the original purchase date, the less accurate historical cost is as a value measure—though this only applies to non-depreciating assets.

Listing the land at the original cost on the balance sheet does not reflect that gain in value. The historical cost concept will recognize that there will be a change in the value of an asset due to obsolescence and deterioration among other reasons. These are recorded on the company books either by depreciation (for physical assets) or amortization (intangible assets). The book value of an asset can be calculated by subtracting the depreciation or amortization amount from the original cost of the asset. For example, if a company purchases 100 shares of a stock for $1,000 and pays $50 in brokerage fees, the investment is recorded on the balance sheet at $1,050.

E Home Household Service : CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Form 6-K – Marketscreener.com

E Home Household Service : CONDENSED CONSOLIDATED FINANCIAL STATEMENTS – Form 6-K.

Posted: Thu, 25 May 2023 21:55:07 GMT [source]

While the principle has been widely accepted and used for decades, some argue that it has limitations and does not provide a complete picture of a company’s financial situation. As a result, alternative accounting methods such as fair value accounting, replacement cost accounting, and current cost accounting have gained popularity. The historical cost principle is a widely used accounting convention for valuing property, plant, and equipment.

Provides a clear audit trail for financial transactions – Advantages of Historical Cost Principle

The historical cost principle is a fundamental accounting concept that determines the initial valuation of assets and liabilities at their original price. It is a principle that has been used for centuries and has remained a cornerstone of accounting practices worldwide. The historical cost principle is one of the basic concepts of accounting and bookkeeping.

The cost will be reported on the balance sheet along with the amount of the asset’s accumulated depreciation. The cost principle, or historical cost principle, is one of the basic accounting principles. Historical cost is applied to fixed assets and is an accounting of the original purchase price. The cost is the amount the company originally paid out to purchase the asset, whereas, the fair market value is the expected amount that the asset will sell for. For example, if a retailer purchases 1,000 units of a product for $10 each, the inventory is recorded on the balance sheet at $10,000. If the product cost increases to $12 each, the inventory is still registered at its original cost of $10,000.

Fair value, on the other hand, takes into account how much an asset is worth right now, taking into account factors such as age and wear and tear. Inflation-adjusted value is the original purchase price, adjusted for inflation since the purchase date—in other words, the change in the value over time. For example, if a company has investments in stocks and bonds, they may use fair value accounting to measure the value of these investments based on current market prices. Real estate and intellectual property can also be valued using fair value accounting. Historical cost accounting is a method of recording and reporting financial information based on the original cost of an asset or liability. The principle assumes that the cost of an asset or liability is a reliable and objective basis for measurement.

- Furthermore, in accordance with accounting conservatism, asset depreciation must be recorded to account for wear and tear on long-lived assets.

- However, companies and accounting professionals need to remain aware of developments in accounting standards and consider alternative methods when appropriate.

- Historical cost is what your company paid for an asset when you originally bought it.

- If the product cost increases to $12 each, the inventory is still registered at its original cost of $10,000.

- The historical cost principle is widely accepted in accounting standards, including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

- For example, marketable securities are recorded at their fair market value on the balance sheet, and impaired intangible assets are written down from historical cost to their fair market value.